Ford's $19.5 Billion Mistake: Why the F-150 Lightning Failed (And What It Reveals About Legacy Auto)

The Lightning That Fizzled: Ford's $19.5 Billion Reality Check

Ford just dropped a bombshell that's sending shockwaves through the automotive industry. The legendary automaker announced a staggering $19.5 billion write-down and halted production of their flagship electric pickup, the F-150 Lightning. Headlines are screaming that this proves Americans don't want EVs, that the electric revolution is dead, and that legacy automakers were right to be skeptical.

But what if I told you those headlines have it backwards?

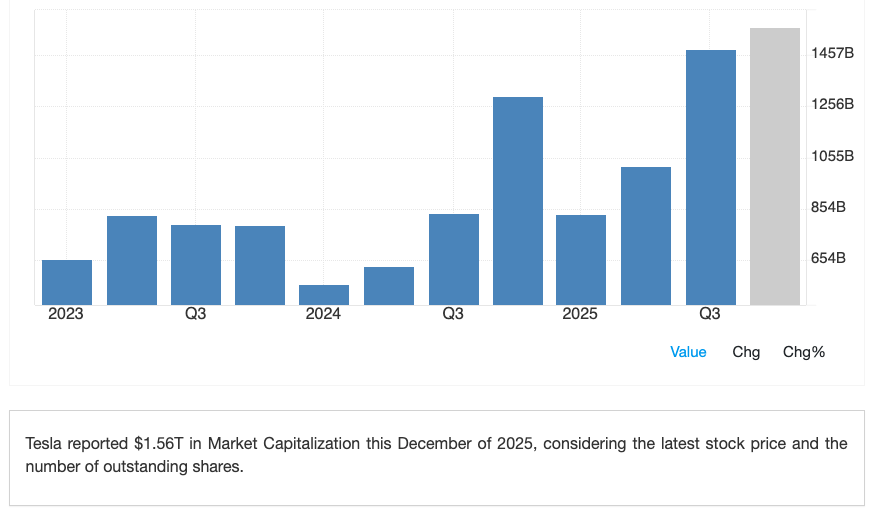

Sitting in a Tesla recording this analysis, we can't help but notice the irony: on the same day Ford announced their massive losses, Tesla hit a $1.56 trillion market cap, roughly 30 times Ford's entire value. The Tesla Model Y became the best-selling car in the world in 2023. So if EVs are supposedly failing, someone forgot to tell the companies actually committed to making them.

The truth is, this isn't an EV failure. It's a strategy failure, and a biblical principle explains exactly why.

The Two Masters Trap: Why Ford Couldn't Commit

Matthew 6:24 warns us: “No one can serve two masters. For you will hate one and love the other; you will be devoted to one and despise the other." Most people know the verse ends with "You cannot serve God and be enslaved to money." but in Ford's case, they tried to serve two different automotive masters, and it cost them dearly.

Master #1: The Legacy Dealership Model

For over 100 years, American car companies have relied on the dealership franchise model. Dealers act as middlemen between manufacturers and consumers, and here's the dirty secret: they barely make money on new car sales, typically just 1-2% profit margins. Their real cash cow? The service department.

For every dollar in new car sales, dealerships generate approximately $5 in service department revenue. Oil changes, transmission work, spark plugs, belt replacements, these recurring maintenance needs keep the lights on and mechanics employed.

This model works beautifully for internal combustion engines with 2,000+ moving parts. But it's fundamentally incompatible with electric vehicles that have around 25 moving parts and require minimal maintenance.

Master #2: The Electric Future

The second master Ford tried to serve was innovation and the electric future. This master demands:

- Direct-to-consumer sales models (like Tesla, Rivian, and Lucid)

- Simplified drivetrains with minimal maintenance

- Long-term investment in battery technology and manufacturing

- Commitment to losing money initially while scaling production

- A complete transformation of company DNA

Ford publicly declared they were "all in" on EVs. They invested billions in the Lightning, broke ground on a massive battery plant in Kentucky with South Korean partner SK Group, and took $2 billion in federal subsidies plus $250 million from Kentucky.

But behind the scenes, dealerships were panicking. Inventory was piling up. Service technicians could see the writing on the wall, their jobs were at risk if EVs actually took over. The middlemen realized they were being cut out of the profit equation.

And when it came time to choose, Ford chose the master that pays the bills today over the one promising tomorrow.

The Real Body Count: Beyond the Headlines

Let's look at the actual damage:

- $13 billion lost on EV sales since 2023

- $19.5 billion write-down announced in 2025

- 1,600 factory workers laid off from the Kentucky battery plant

- $6 billion to break the partnership with SK Group

- One factory building constructed but never used, now being repurposed for AI data centers (another potential bubble Ford is chasing)

The Kentucky plant was supposed to be the future of American EV manufacturing. Now it's becoming battery banks for home backup and AI data centers, two moves that smell suspiciously like chasing the next trend rather than building sustainable strategy.

Why This Isn't an EV Demand Problem

Here's what the doom-and-gloom headlines won't tell you:

If American consumers truly didn't want EVs, how do we explain:

- Tesla's explosive growth and trillion-dollar+ valuation

- The Tesla Model Y becoming the world's best-selling vehicle in 2023

- Rivian's passionate customer base (despite not yet making a profit per vehicle)

- Hyundai/Kia's successful EV lineup expansion

- The fact that EV prices have dropped significantly, making them more accessible

Gary Black from the Future Fund put it perfectly: "At best, Ford can't make money on EVs." That's not an indictment of EVs, it's an indictment of Ford's ability to execute.

Consumers don't want $60,000-$70,000 EVs that lose half their value the moment they leave the lot. They want affordable options like the $30,000 2027 Chevy Bolt or New Nissan Leaf. They want vehicles that make sense economically, not compliance cars built solely to meet government mandates.

The Political Smokescreen: CAFE Standards and Tax Credits

Ford's retreat conveniently coincided with the Trump administration rolling back CAFE (Corporate Average Fuel Economy) standards. Jim Farley, Ford's CEO, was there at the announcement, and he looked pretty excited about it.

Let's break down what was really happening:

The CAFE Standards Game

CAFE regulations require manufacturers to meet fleet-wide emission standards. The bigger the vehicle, the less strict the standards. This created perverse incentives:

- Manufacturers shifted from compact sedans to massive SUVs and trucks

- They built "compliance EVs" just to offset their gas-guzzler averages

- Innovation took a backseat to regulatory gaming

The Tax Credit Crutch

The $7,500 federal EV tax credit didn't help consumers as much as it helped manufacturers. Most automakers simply inflated prices by $7,500, pocketing the subsidy as pure profit margin. When those credits became more restricted, Ford suddenly lost interest in EVs.

Add in ZEV (Zero Emission Vehicle) credits and other subsidies, and you realize Ford wasn't selling EVs, they were selling regulatory compliance.

When the regulations relaxed, Ford took the exit ramp hard, merging across four lanes of traffic to get back to what they know: gas-guzzling trucks that keep dealerships happy.

The Hybrid Mirage: A Bridge to Nowhere

Ford's new strategy? Extended-range electric vehicles (EREVs), basically hybrids with fancy marketing. They're pitching this as the best of both worlds: electric for daily driving, gas for long trips.

Here's why that's a bridge to nowhere:

Imagine a bridge across a river. A proper bridge takes you from point A to point B, from gas to fully electric. But hybrid technology doesn't actually take you across. Instead, it puts a picture of the other side closer to you while keeping you stuck where you are.

Now instead of maintaining one system (either gas or electric), you're maintaining two:

- An internal combustion engine with all its complexity

- An electric motor and battery system

- Double the potential failure points

- Double the maintenance costs

Toyota has 10 hybrid models but only one true EV. That's not innovation, that's hedging bets while keeping dealership service departments fully employed.

What This Means for You

If you're a current F-150 Lightning owner, your resale value will likely take a hit, though it's possible these trucks could become rare collector's items since they're no longer in production. Only time will tell.

For prospective EV buyers, this actually clears the field. You're now left with companies that are genuinely committed to electric:

- Tesla: The obvious leader with Supercharger network and continuous innovation

- Rivian: Purpose-built EVs with passionate following (R2 hopefully brings profitability)

- Lucid: Luxury performance EVs pushing technological boundaries

- Hyundai/Kia Group: Serious EV commitment with 800-volt architecture and growing lineup

If you're a Ford loyalist, get excited about... hybrids? It's the bridge technology that keeps you tethered to the past.

The Stewardship Question: What Would Jesus Drive?

Here at Elevate Motor Co., we often explore the intersection of faith and technology. If we have the technology to reduce emissions, lower operating costs, and create a cleaner future for the next generation, don't we have a responsibility to pursue it?

Ford's decision prioritizes short-term profits and appeasing existing power structures over long-term innovation. That's a business decision, certainly, but it's also a values decision.

The "two masters" principle isn't just about personal finance. It's about where we place our ultimate loyalty. Companies that try to please everyone end up serving no one well.

The Bottom Line: Detroit Isn't Ready for the Future

Ford's $19.5 billion write-down is an admission of failure, but not EV failure. It's a failure of vision, commitment, and courage. It's what happens when you try to serve the legacy dealership model while competing with companies built for the electric age.

Detroit could have led this transition. American innovation could have dominated the EV revolution. Instead, we're watching legacy automakers retreat to their comfort zones while Tesla, Chinese manufacturers, and Korean companies race ahead.

The future is still electric, even if Ford isn't ready for it.

Those 1,600 Kentucky factory workers deserved better. American manufacturing deserved better. And consumers who actually want affordable, innovative EVs definitely deserve better.

What's Your Take?

Do you think Ford made the right strategic move pivoting back to hybrids and gas trucks? Or are they just delaying the inevitable while competitors leave them in the dust? Drop a comment under the video and let us know your thoughts.

And if you found this analysis helpful, subscribe to Elevate Motor Co. for more real-world EV insights delivered with a perspective you won't find anywhere else.

Because at the end of the day, you can't serve two masters—and Ford just showed us which one they chose.